ORLANDO, Fla. — The drycleaning industry faces the same economic pressures reshaping manufacturing, retail and service businesses across the country: Finding workers is harder than ever, and customers are behaving in radically different ways depending on their income level.

Chris Kuehl, chief economist for Armada Corporate Intelligence, explored these factors in his Clean Show presentation, “Economic Outlook: What to Expect in 2025 and Beyond.”

In Part 1 of this series, Kuehl explained how the American consumer market has fractured into three distinct tiers and why the labor shortage represents the defining challenge for businesses across all sectors.

Today, we’ll conclude by looking at other market forces shaping today’s economy and how they may affect the drycleaning industry.

Construction and Facilities Growth

Non-residential construction — particularly relevant for dry cleaners serving hotels, restaurants, and commercial clients — is growing aggressively. The sector slowed slightly but is expected to resurge in 2026, says Kuehl, driven by transportation projects and energy infrastructure.

Energy infrastructure represents a massive upcoming need. “We’re going to need 44 additional terawatts of power just to handle AI,” Kuehl says. Throughout the Clean Show, he noted, efficiency was a major emphasis, “trying to use as much or as little electricity as possible, which is what’s driving everything.”

For dry cleaners, this emphasis on energy efficiency isn’t just an environmental concern — it’s an economic necessity as power demands increase across all sectors. Equipment that reduces energy consumption will become increasingly valuable as utilities struggle to meet demand.

Residential construction is also rebounding, though with different motivations than past cycles. Boomers are looking for smaller homes and moving into senior living. Gen Z isn’t ready to commit to single-family homes, but millennials are now having kids. “And the fastest way to get somebody out of an apartment is to give them children,” Kuehl says.

Migration patterns are accelerating growth in unexpected places. Living comfortably as a single person in California requires an income of $200,000 a year, Kuehl says. In Fargo, North Dakota, the same lifestyle costs $50,000. “And that’s why Fargo is one of the fastest-growing cities in the United States,” he says.

For cleaners, these migration patterns suggest opportunity in unexpected markets. As populations shift to more affordable cities, new customer bases emerge in regions that previously had limited demand for drycleaning services.

Manufacturing and Machinery Growth

Manufacturing in general is growing faster than expected, driven by demand for automation. Companies facing worker shortages are turning to robots, and that trend is accelerating down to smaller businesses — including dry cleaners who need to process more garments with less staff.

“When I was working with manufacturers, if they were smaller than 100 or 200 employees, they didn’t really look at robots,” Kuehl says. “It was too expensive for them. I now talk to 10-person job shops that are bringing in a robot.”

Why the shift? “Three of their employees are over 70, and they can’t find anyone to replace them,” he says, describing a typical scenario. “So, it’s going to have to be a robot, because the only option I have is to hire a Cub Scout and try to train him.”

For dry cleaners facing these workforce shifts, Kuehl believes that investment in advanced equipment and automation may be the only viable path forward. The question isn’t whether to automate, but how quickly and which processes to prioritize.

Kuehl sees potential opportunities, however, based on what he witnessed from Clean Show exhibitors. “Who knew these machines even existed?” he says about some of the automated technologies on display. “It blows my mind.”

The Home Robot Revolution

The next major technology shift is already visible: domestic robots. “By the end of this decade, it is expected that one out of every three households in the United States will have a domestic robot,” Kuehl says.

He was skeptical until his own back surgery in December left him temporarily helpless. During his convalescence, he fell out of bed and couldn’t get back up on his own.

“The night nurse was this charming but extremely small woman who weighed about 100 pounds,” Kuehl says, “so she calls in a robot. The robot comes into my room, picks me up, puts me in the bed, pulls my covers up over my shoulders, and says, ‘Good night.’ And I want one now. I want one badly.”

Current domestic robots can cook, clean and mow yards, but they currently cost around $900,000 each. As prices drop, however, adoption will accelerate. “I just think of it as ‘The Jetsons’ was a documentary, not a cartoon,” Kuehl says.

For dry cleaners, the rise of domestic robots raises an interesting question: Will robots that can wash and fold laundry at home reduce demand for professional services? Or will affluent customers — who already view time as their most valuable commodity — simply add laundry to the list of tasks they delegate to machines while continuing to use dry cleaners for garments requiring professional care?

The Bottom Line

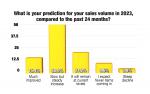

The economic outlook for 2025 remains moderate, with growth around 2.6-3%, Kuehl says, and inflation pressures building slowly. The real story involves structural changes: a fractured consumer market, an accelerating labor crisis, and rapid automation across industries that will reshape drycleaning operations for years to come.

“We’re seeing all of this demand for more machine activity, not just robots in the home,” Kuehl says. “Companies have had to turn to robots in order to make up for that lack of people.”

For drycleaning owners, the message is clear: workforce challenges will define competitive advantage more than tariffs or inflation, and automation investments may be a critical response to the demographic realities our society will face.

For Part 1 of this series, click HERE.

Have a question or comment? E-mail our editor Dave Davis at [email protected].